Profits are important for all organizations, and healthy profit margins are a strong indicator of an organization’s strength.

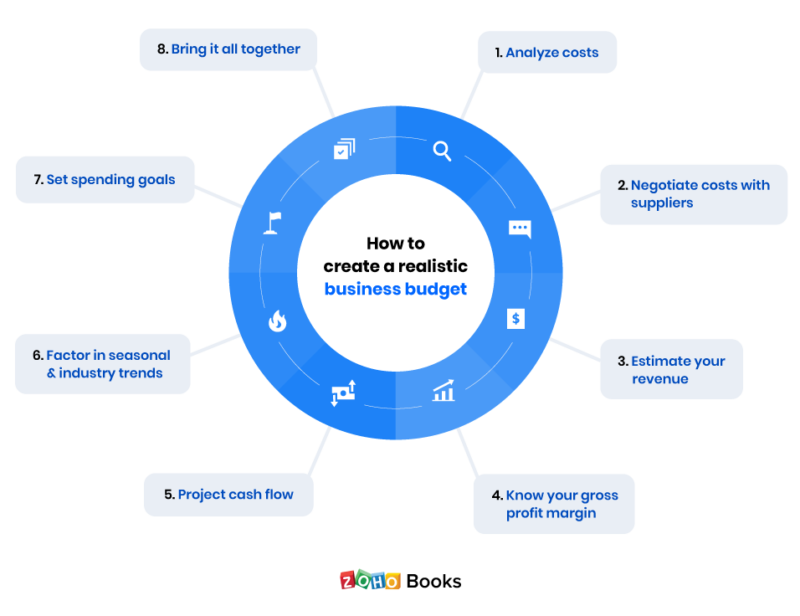

Not-for-profit organizations use their profit margins to reinvest in the facilities and development of the organization. Profit margins allow for returns for the business owner or investors. Target Profit MarginĮvery organization, whether they are for-profit or not-for-profit, should have a targeted profit margin. Projections of costs should be identified, laid out, and incorporated into the departmental budget responsible for completing the goal.įor example, if the sales department aims to increase sales by 10%, costs associated with the increased sales (additional marketing materials, travel, entertainment) should be incorporated into that budget. This is where the cost of implementing goals is incorporated into the annual budget. Goal-related projects should also be given budgets.Įach initiative should have projected costs associated with the goals. These are expenses that can and should be budgeted and controlled.įor example, if higher Christmas sales drive overtime costs temporarily, those costs should be budgeted. Variable costs are costs that fluctuate from month to month, supply costs, overtime costs, etc. Projecting fixed costs is simply a matter of looking at the monthly predictable costs that do not change.Įmployee compensation costs, facility expenses, utility costs, mortgage or rent payments, insurance costs, etc.įixed costs do not change and are a minimal expense that needs to be funded in the budget.įor example, if there are open staff positions, the cost to fill those positions should be part of fixed cost projections. The projected growth may be tied to organizational goals and planned initiatives that will initiate business growth.įor example, if there is a goal to increase sales by 10%, those sales projections should be part of the year’s revenue projections. Revenue projections should be based on historical financial performance, as well as projected growth income. The budget provides the financial resources to achieve goals.įor example, if your organization has outgrown its facility, and there is an objective to increase space, there must be dollars budgeted to expand or move business operations. This is typically the responsibility of the management team, board, or business owner. Goals need to be developed, and there needs to be accountability for achieving goals. Business GoalsĪnnual business goals are the steps an organization takes to implement its strategic plan, and it is these goals that need to be funded by the budget. This ensures that organizational resources are used to support the strategy and development of the organization. The first step in the budgeting process is having a written strategic plan. This is articulated through a written Vision and Mission Statement.Ī Strategic Plan is HOW the organization plans to achieve its mission. Strategic PlanĮvery organization, no matter the size, should know why it exists and what it hopes to accomplish. 10 Steps To Creating And Managing A Small Business Budget 1. This intentional plan helps keep them from spending money in areas that do not align with the vision (what we are trying to do) and mission (why we are doing it). Organizations that stay focused on their strategy and plan know exactly where they want to spend their resources. So, where do we begin?Īs with most things that come with managing an organization, budgeting needs to be driven by the vision (what we are trying to accomplish) and the strategic plan (the steps to get there).

Very similar to our personal finances, discipline, and planning should be the cornerstone of a business budgeting process. Developing and managing a budget is how successful businesses allocate, track, and plan fiscal spending.Ī formal budgeting process is the foundation for good business management, growth, and development. When getting a small business off the ground, it is crucial to determine how the bills are going to be paid.Įvery small business needs a budget. We have had to change how we clean, work, and manage our small business budget!

Corporate budget planning process how to#

If we have learned anything this year, it has been how to pivot our businesses.

0 kommentar(er)

0 kommentar(er)